This standard deals only with Events occurring after the Balance Sheet date. Even though the Standard’s name starts with contingencies, all the paragraphs related to ‘contingencies’ have been withdrawn by ICAI. From 1-4-2004, contingencies are dealt by AS-29 – “Provisions, Contingent Liabilities and Contingent Assets”.

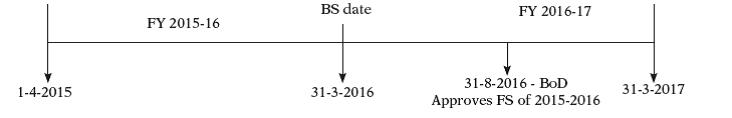

Before we start the main discussion, you need to understand the sequence of approval of financial statements in case of companies.

Step 1: After the financial year end, Board of Directors (BoD)/Management prepare the financial statements and approve the same;

Step 2: Auditor of the company conducts audit and issues a report on the financial statements;

Step 3: Audited financial statements are adopted by the Members of the company in the AGM;

Concept Capsule 1

Who is responsible to prepare the financial statements of an entity and who approves the financial statements?

Look at the above diagram, financial statements of 2015-16 are approved by the approving authority (BoD in case of company) on 31st Aug, 2016.

Financial statements approved means that, the books of account of the financial year are closed. Based on the above diagram, the entity can record any journal entry related to FY 2015-16 till 31st Aug., 2016 only. If an entity identifies any income or expenditure related to FY 2015-16 subsequent to 31st Aug., 2016, that income or expenditure should be recorded in FY 2016-17 as a prior period item. (Refer AS 5 for more information on this).

Concept Capsule 2

The factory is painted in March 2016, and the painter submitted the bill in April 2016. The accountant of the company did not make a provision for the expense as on 31-3-2016. FY 2015-16 financials are approved on 30-9-2016.

(a) Can the accountant record the JE for the painting expenses in FY 2015-16 OR should he record in 2016-17?

(b) If the bill is received after 30-09-2016 what would be the treatment?

(a) The expense is incurred during FY 2015-16 and it should be recognised as an expense in the same year. Information of the expense is received before the date of approval of financial statements; hence the entity should recognise the transaction as on the balance sheet date i.e. in FY 2015-16.

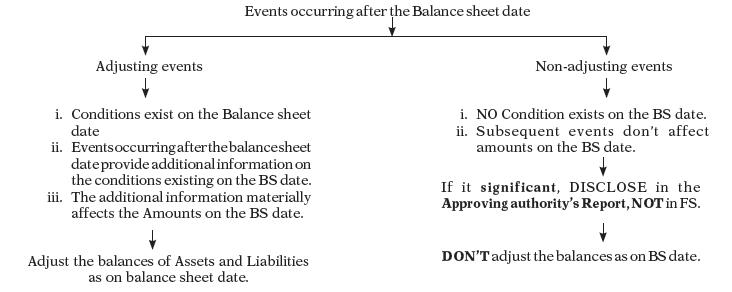

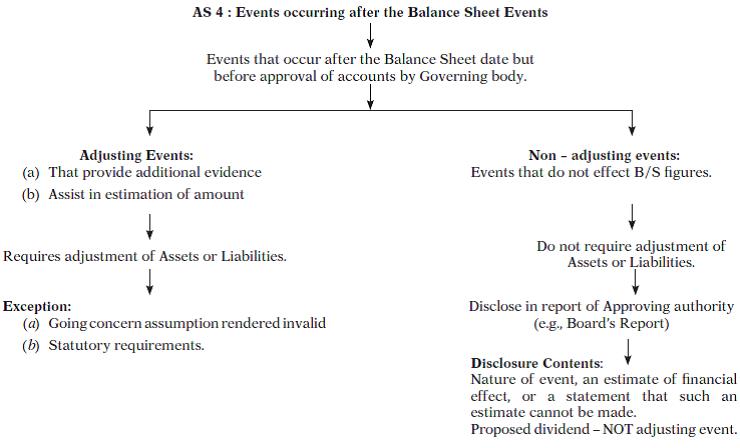

Events occurring after the balance sheet date: These are significant events, which occur between the balance sheet date and financial statements approval date. These significant events can be favourable or unfavourable to the entity.

Significant events – Material events, which can influence the economic decisions of the users of financial statements.

The whole discussion in this standard is whether the events occurring after the balance sheet date should be recorded as on balance sheet date OR in the next financial year. [e.g. (look at the above diagram) whether it should be recognised in FY 2015-16 OR FY 2016-17];

Events occurring after the balance sheet date are classified into two i.e. adjusting events and non-adjusting events; let us understand this concept from the below picture:

The primary objective of the standard is to ensure the completeness, that all the transactions and related information should be updated in financial statements.

Adjusting Events

Non-Adjusting Events

The above concepts can be clearly understood with the help of the following the concept capsules:

Concept Capsule 3

While preparing the financial statements for the year ended 31-3-2018, X Ltd. made a provision for doubtful debts @ 5% on accounts receivables balance. In Feb., 2018, a debtor for ` 2 lakh had suffered heavy loss due to an earthquake. The loss of debtor was not covered by any insurance policy. In April, 2018, the same debtor became insolvent. Financial statements are approved on 30-9-2018. Discuss the accounting treatment as per AS 4 in the financial statements ended 31st March, 2018.

Concept Capsule 4

Continuing with the above question – The accounts receivable balance is ` 2 lakh as on 31-3-2018. But earthquake took place in April 2018 and the debtor became insolvent in May 2018. Discuss the accounting treatment as per AS 4.

Concept capsule 5

Continuing with the above question – There was no balance of accounts receivable as on 31-3-2018 and X Ltd. sold goods in April 2018 and earthquake took place in May 2018 and the debtor became insolvent in July 2018. Discuss the accounting treatment as per AS 4.

Concept Capsule 6

A company has filed a legal suit against the debtor from whom ` 15 lakh is recoverable as on 31.3.2017. The chances of recovery by way of legal suit are not good as per legal opinion given by the counsel in April, 2017. Can the company provide for full amount of ` 15 lakhs as provision for doubtful debts? Discuss.

As per AS 4, assets and liabilities should be adjusted for events occurring after the balance sheet date that provide additional evidence to assist the estimation of amounts relating to conditions existing at the balance sheet date.

Concept Capsule 7

X Ltd. invested `100 lakh in Y Ltd. in April 2018 but the negotiations had started in Jan. 2018. As per AS 4 – In which financial year X Ltd. should account for the investment?

Concept Capsule 8

X Ltd. purchased a building for `50 lakh in Jan. 2018, and the agreement to purchase was concluded in Jan. 2018. X Ltd’s financial year ends on 31st March. In the month of April 2018, the same building is registered in the name of X Ltd. In which financial year X Ltd. should account for the building?

Concept Capsule 9

X Ltd. holds current investments as on 31-3-2018. Cost of investments is ` 50 lakh and fair market value is `55 lakh (on 31-3-2018) and the company measured it at ` 50 lakh as per AS 13 (i.e. Cost or FMV whichever is less). Financial statements are approved by BODs on 30-09-2018. Due to subsequent market conditions the value of investments fell down to `40 lakh. Whether X Ltd. needs to value the investments at `50 lakh or `40 lakh on 31-3-2018? Discuss.

If the approving authority wants to disclose non-adjusting events in their report, they should disclose the following information:

Some examples of non-adjusting events:

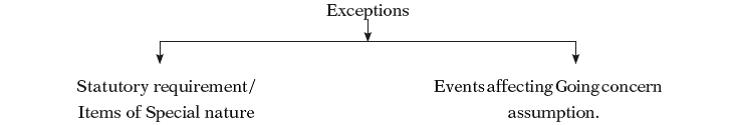

Exception means even though it is a non-adjusting event it should be adjusted as on balance sheet date. There are two exceptions to the rule of adjusting events:

Concept Capsule 10 (PROPOSED DIVIDEND)

On 31-08-2017, the Board of Directors of X Ltd. proposed dividend of 10% for FY 2016-17. Financials of 2016-17 are approved by BoD on 30-09-2017. Discuss the accounting treatment of the proposed dividend as per AS 4.

Concept Capsule 11

After the closure of financial year i.e. 31-3-2018, there was a severe earthquake. The company lost its building and major plant and the extent of loss is beyond repair. The company doesn’t have adequate funds to replace the same. Discuss your views based on AS 4.

Concept Capsule 12

X Ltd. financial statements of 2017-18 are approved by the BoD on 30-09-2018 & financial statements are adopted by the AGM on 15-10-2018. On 30-11-2018, the company identified an expenditure (omission of expense) which is relating to 2017-18. How to deal with the expenditure? Discuss.

Ans: As per AS-4, the unexpected increase in the sale price of petrol by the Government after the balance sheet date cannot be regarded as an adjusting event as it doesn’t represent a condition existing as on the balance sheet date. Hence revenue (due to increase in sales price) should be recognized only in the subsequent year with proper disclosure.

Ans: Even if the cheques bear the date 31st March or before, the cheques received after 31st March do not represent any condition existing as on 31st March. It means, it is not an asset under the control of the entity as on the balance sheet date. Hence, there is no situation/condition exist as on 31st March.

Considering the above points, collection of cheques after the balance sheet date is NOT an adjusting event. So recognising these as cheques in hand is not consistent with AS-4. Moreover, the collection of cheques after the balance sheet date does not represent any material change or commitments affecting the financial position of the enterprise and therefore no disclosure in the Director’s Report are necessary.

Ans: The Company’s financial statements were finalized on 15-5-2018. But it discovered that it has to expend an additional `50 crore only on 16-5-2018, therefore it does not amount to an event occurring after the balance sheet date.

The company has to make a provision in the financial year 2018-19 i.e. in the next financial year.

Ans: In this case the incidence, which was expected to push up cost, became evident after the date of approval of the accounts. So, it is not an ‘event occurring after the balance sheet date’. However, this may be mentioned in the Report of Approving Authority i.e. Board of Director’s report.

Ans: Since the demand already existed as on the balance sheet date, and later the Company received the notice, it becomes an adjusting event and the company has to make a provision for `43 lakh (27 + 16).

(As the company has already deposited ` 16 lakh in the subsequent year hence it should make a provision for the same as of 31-03-2018 and the remaining claim which is a probable outflow ` 27 lakh also to be provided).

The remaining amount of ` 35 lakh (62-27 lakh) should be disclosed as contingent liability as per AS 29.

Ans: Though the theft, by the cashier `2,00,000, was detected after the balance sheet date (before approval of financial statements) but it is an additional information materially affecting the determination of the cash amount relating to conditions existing at the balance sheet date. Therefore, it is necessary to make the necessary adjustments in the financial statements of the company for the year ended 31st March, 2018 for recognition of the loss amounting to `2,00,000.

Ans: As per AS 4—

(i) Fire has occurred after the balance sheet date and also the loss is totally insured. Therefore, the event becomes immaterial and the event is non-adjusting in nature.

(ii) The contingency is restricted to conditions existing at the balance sheet date. However, in the given case, suit was filed against the company’s advertisement by a party on 10th April for amount of ` 20 lakh. Therefore, it does not fit into the definition of a contingency and hence is a non-adjusting event.

(iii) In the given case, proposal for deal of immovable property was sent before the closure of the books of account. This is a non-adjusting event as only the proposal was sent and no agreement was effected in the month of March i.e. before the balance sheet date.

(iv) As the term and conditions of acquisition of business of another company had been decided by the end of March, acquisition of business is an adjusting event occurring after the balance sheet date. Adjustment to assets and liabilities is required since the event affects the determination and the condition of the amounts stated in the financial statements for the financial year ended on 31st March.

(v) Since the financial statements have been approved before detection of theft by the cashier of `2,00,000, it becomes a non-adjusting event and no disclosure is required in the BoD report.

Ans: As per AS 4, adjustments to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of the amounts relating to conditions existing at the balance sheet date.

In the given case, since Raj Ltd. was sued by a competitor for infringement of a trademark during the year 2017-18 for which the provision was also made by it, the decision of the Court on 18th May, 2018, for payment of the penalty will constitute as an adjusting event because it is an event occurred before approval of the financial statements. Therefore, Raj Ltd. should adjust the provision upward by ` 4 lakhs to reflect the award decreed by the Court to be paid by them to its competitor.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content: